do nonprofits pay taxes on lottery winnings

As soon as you have won the drawing and have the right to the winnings you have income that is subject to tax. Up to an additional 13 could be withheld in state and local taxes depending on where you live.

What Is Fundraising David Trimner Principal Ppt Download

Gambling and Lottery Winnings - Beta Solutions CPA LLC.

. Still youll probably owe more when taxes are due since the top federal tax rate is 37. Only two states out of the 43 states that participate in multistate lottery taxes from non-residents. The withholding rates for gambling winnings paid by the New Jersey Lottery are as follows.

You cant deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance. Additionally those over the age of 75 must pay a sales and use tax on any winnings over 75. Arizona and Maryland both tax the winnings of people who live out-of-state.

Right off the bat lottery agencies are required to withhold 24 from winnings of 5000 or more which goes to the federal government. Most states dont withhold taxes when the winner doesnt reside there. Theres no getting around paying those taxes but setting up a trust fund can be a good idea for a variety of reasons.

You cannot legally avoid paying taxes on your lottery winnings. The organization reports the grossed up amount of the prize fair market value of prize plus amount of taxes paid on behalf of winner in box 1 of Form W. You can offset that to some extent by giving to charity but you may not be able to offset it entirely.

Yes some seniors in New York must pay taxes on lottery winnings. If the proceeds are 5000 or less the prize payment is not considered New York source. This means your income will be pushed into the highest federal tax rate which is 37.

How much taxes do you pay on 1000. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. The nonprofit doesnt have to pay tax on either lottery winnings that it paid for or on contributions from the Pool members.

Does He have to pay tax on it if hes 64 years old and a senior ci. But if the Pool members were entitled to the winnings when they made the nonprofit a member of the Pool they will be taxed on the winnings and will deduct the value of the contribution as a partial offset. Lottery winners pay a large chunk of their winnings to the IRS.

If you claim a contribution to a non-qualified charity the IRS will deny the deduction adjust the numbers on your tax return and send you a bill. Thats because you are not actually making a charitable donation but are gambling on the chance that you have the winning ticket. For this reason many nonprofits raise money by conducting gambling also called gaming activities such as bingo lotteries raffles pull-tabs punch boards tip boards pickle.

To prevent abuses and tax evasion the IRS imposes strict requirements on nonprofits that make money through gambling events. We treat everything from sports 5050s to travel lotto vouchers purchased by your non-profit agencies for the chance of being tax exempt as part of the windfall category. Under this formula the organization must pay withholding tax of 3333 of the prizes fair market value.

There is no way you can work around thisthe US. Before the winner receives any of the money however the IRS automatically takes 24 of the winnings. The tax-free category for lottery wins is Lotto Max.

As well as Canadian lottery winnings being considered windfalls they do not have to be paid into a government tax account. Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. When the lottery winner does reside in a specific state then most of the states in the USA do not withhold lottery tax by state.

Government does not give tax breaks to. Dues to fraternal orders and similar groups. Javier Simon CEPFMar 18 2022.

Those rates apply whether you choose to take winnings in a lump sum or annuity. You can keep your name private for one and you also can save money if. The IRS will usually require that the lottery company withhold taxes from your winnings before you even receive a check.

The same tax liability from winning New York State lottery games also applies to multi-state games such as Mega Millions and Powerball. That means the federal tax rate of 24 will immediately be withheld along with the highest New York state tax rate of 882. 8 for Lottery payouts over 500000.

Can I change the amount of tax the lottery withholds. Before you see a dollar of lottery winnings the IRS will take 25. But depending on whether your winnings affect your tax bracket there could potentially be a gap between the mandatory withholding amount and what youll ultimately owe the IRS.

He bought one of those scratch and win lottery tickets. Many people love to gamble especially when its for a good cause. In fact of the 43 states that participate in multistate lotteries only two withhold taxes from nonresidents.

Reporting Lottery Wins A charitable gift from the lottery or any gambling proceeds does not allow you to escape federal taxes on your winnings. The tax rate will be determined by your income. Lottery prize won while you were a nonresident the tax treatment depends on the amount of the proceeds and when you won your prize.

Do senior citizens in Pennsylvania have to pay taxes on. The state of New York requires that those over the age of 70 must pay income taxes on any winnings over 10000. A friend of mine is 64 or older and he lives in Pennsylvania.

But you can reduce your tax liability by taking your lottery winnings in installments donating a portion of it to charity and deducting any gambling losses. North Carolinas State Education Lottery has been raking in some big totals in recent years. The rest of the winnings are.

5 for Lottery payouts between 10001 and 500000. The key to avoiding income taxes is to give the ticket or an interest in the ticket to the charity before the drawing and before you are entitled to the winnings. Winnings are taxed the same as wages or salaries are and the total amount the winner receives must be reported on their tax return each year.

This service is similar to paying a tutor to help improve your skills. 3346 satisfied customers. These states are Maryland and Arizona.

Your lottery winnings are taxed just as if they were an ordinary income bonus. New Jersey Income Tax withholding is based on the. 8 for Lottery payouts over 10000 if the claimant does not provide a valid Taxpayer Identification Number.

As far as donating a percentage of your lottery ticket goes not sure that having the church official purchase it and adding a stipulation would make you.

Lottery Winners Pour Millions Into Nonprofits Make Diversity A Priority

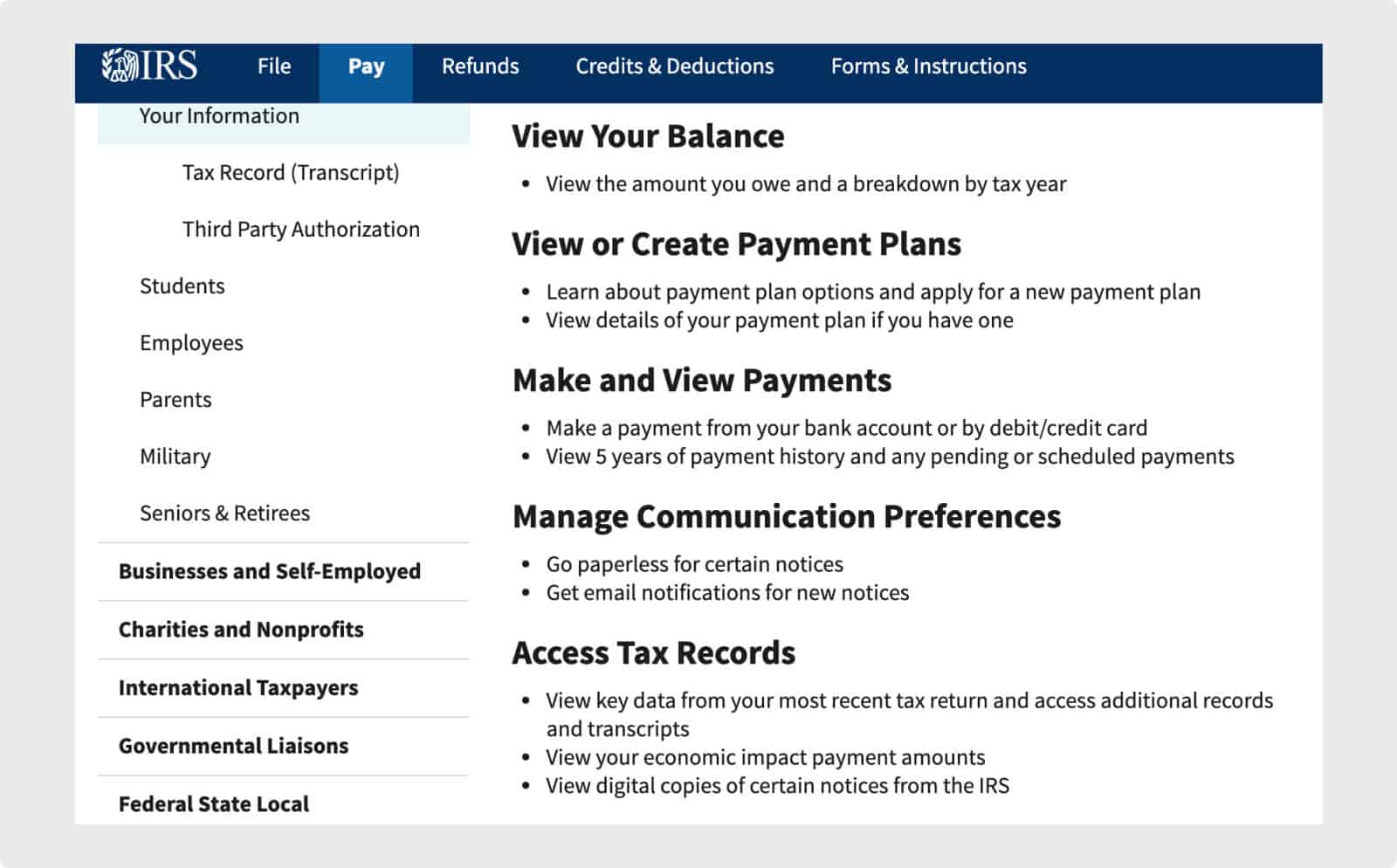

Irs 2020 Stimulus Check Tutorial Still Haven T Received Your Stimulus Check From The Irs Try Visiting This Page At Irs Gov Abc3 Irs Filing Taxes Tax Return

The Complete List Of Tax Deadlines For Small Businesses Simplifyllc

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/61947797/shutterstock_254400031.0.0.jpg)

Lottery Winners Should Start A Private Foundation No Really Vox

Gaming Gambling Rules For 501c3 Nonprofit Fundraising

A Quick Guide To Deducting Your Donations Charity Navigator

Games Of Chance Raffles And Charity Auctions National Council Of Nonprofits

Can Not For Profits Use Gift Cards Tax Considerations

Caesars Citizenship Citizencaesars Twitter

Can Not For Profits Use Gift Cards Tax Considerations

China Considers Turning Tutoring Firms Into Non Profits Keep Them From Ipo Bloomberg

Lottery Winners Should Start A Private Foundation No Really Vox

A Quick Guide To Deducting Your Donations Charity Navigator

Gambling With Your Nonprofit Charity Lawyer Blog Nonprofit Law Simplified

Fundraising Raffles Rules Regulations

Pink Ladies 320k Jackpot A Charitable Game Gone Massive Non Profit News Nonprofit Quarterly